An Unbiased View of Pvm Accounting

An Unbiased View of Pvm Accounting

Blog Article

An Unbiased View of Pvm Accounting

Table of ContentsUnknown Facts About Pvm Accounting5 Easy Facts About Pvm Accounting DescribedThe Ultimate Guide To Pvm AccountingThe Only Guide for Pvm AccountingPvm Accounting Can Be Fun For EveryoneA Biased View of Pvm Accounting

Guarantee that the bookkeeping process conforms with the regulation. Apply called for building and construction accounting requirements and procedures to the recording and reporting of building task.Understand and keep basic expense codes in the accounting system. Connect with numerous funding agencies (i.e. Title Company, Escrow Business) regarding the pay application process and requirements needed for repayment. Handle lien waiver disbursement and collection - https://ameblo.jp/pvmaccount1ng/entry-12853215450.html. Display and solve financial institution issues consisting of cost anomalies and examine differences. Help with executing and preserving internal monetary controls and treatments.

The above declarations are meant to define the basic nature and degree of work being carried out by people assigned to this category. They are not to be taken as an exhaustive list of obligations, tasks, and abilities called for. Workers may be needed to carry out responsibilities outside of their normal duties every so often, as needed.

Top Guidelines Of Pvm Accounting

You will aid support the Accel team to make certain delivery of effective on schedule, on budget plan, projects. Accel is looking for a Building Accounting professional for the Chicago Office. The Building and construction Accountant executes a variety of audit, insurance coverage compliance, and job management. Works both individually and within particular departments to maintain financial documents and ensure that all records are maintained present.

Principal duties include, however are not limited to, taking care of all accounting features of the company in a timely and precise manner and supplying records and timetables to the firm's certified public accountant Firm in the preparation of all financial statements. Guarantees that all bookkeeping treatments and features are taken care of accurately. Responsible for all monetary documents, pay-roll, financial and everyday operation of the bookkeeping function.

Functions with Job Supervisors to prepare and publish all monthly billings. Produces monthly Job Price to Date reports and working with PMs to reconcile with Task Supervisors' budgets for each task.

Indicators on Pvm Accounting You Need To Know

Efficiency in Sage 300 Construction and Realty (previously Sage Timberline Office) and Procore building and construction management software application a plus. https://www.blogtalkradio.com/leonelcenteno. Must likewise be competent in various other computer software application systems for the prep work of records, spread sheets and other bookkeeping analysis that might be required by administration. Clean-up bookkeeping. Have to possess strong organizational abilities and ability to prioritize

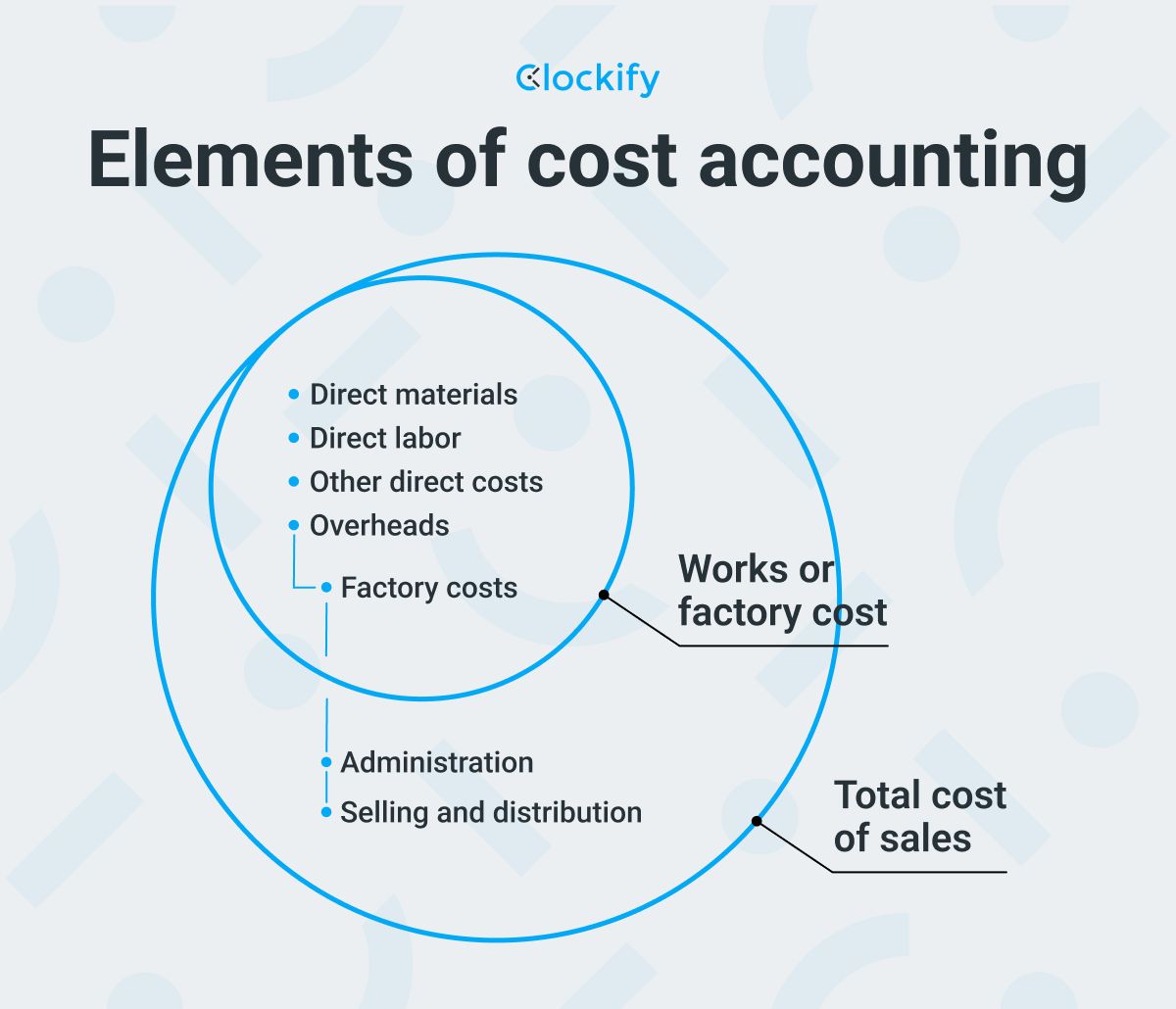

They are the monetary custodians that make certain that construction jobs continue to be on budget, abide by tax guidelines, and maintain monetary openness. Building and construction accounting professionals are not simply number crunchers; they are critical partners in the construction process. Their primary function is to handle the financial elements of building jobs, making sure that sources are assigned successfully and economic threats are decreased.

The Main Principles Of Pvm Accounting

By preserving a tight hold on project finances, accounting professionals help stop overspending and financial troubles. Budgeting is a keystone of successful building and construction jobs, and building and construction accountants are important in this respect.

Navigating the facility web of tax obligation guidelines in the construction market can be tough. Building accounting professionals are well-versed in these laws and guarantee that learn the facts here now the task adheres to all tax obligation needs. This includes handling payroll taxes, sales tax obligations, and any kind of other tax commitments specific to construction. To excel in the function of a building accountant, people require a strong academic foundation in bookkeeping and money.

Additionally, accreditations such as State-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT) or Certified Building Sector Financial Professional (CCIFP) are extremely concerned in the sector. Functioning as an accounting professional in the construction industry includes a special collection of difficulties. Building projects commonly include tight deadlines, changing laws, and unexpected costs. Accountants should adapt quickly to these difficulties to maintain the project's financial wellness undamaged.

Top Guidelines Of Pvm Accounting

Expert qualifications like CPA or CCIFP are additionally very suggested to demonstrate know-how in building bookkeeping. Ans: Construction accounting professionals develop and check spending plans, determining cost-saving opportunities and making certain that the job remains within spending plan. They likewise track expenses and projection monetary needs to avoid overspending. Ans: Yes, building accountants manage tax compliance for building projects.

Introduction to Building And Construction Bookkeeping By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies need to make challenging options amongst numerous economic options, like bidding on one job over an additional, selecting funding for products or devices, or setting a job's earnings margin. On top of that, building is an infamously unstable industry with a high failing price, slow time to repayment, and irregular capital.

Regular manufacturerConstruction company Process-based. Production entails duplicated processes with easily recognizable prices. Project-based. Manufacturing requires different processes, products, and devices with varying costs. Taken care of place. Production or manufacturing occurs in a solitary (or a number of) regulated locations. Decentralized. Each task occurs in a new place with differing site conditions and one-of-a-kind difficulties.

Unknown Facts About Pvm Accounting

Constant use of various specialty specialists and providers impacts efficiency and money circulation. Payment arrives in complete or with routine repayments for the complete contract quantity. Some part of settlement may be held back until task conclusion even when the professional's work is finished.

Normal production and short-term agreements result in convenient capital cycles. Irregular. Retainage, sluggish payments, and high ahead of time expenses bring about long, uneven cash circulation cycles - Clean-up accounting. While standard manufacturers have the benefit of controlled settings and enhanced manufacturing processes, construction business have to regularly adapt to every brand-new job. Also rather repeatable projects need modifications because of website conditions and various other variables.

Report this page